Levy Stable models of Stochastic Volatility¶

This tutorial demonstrates inference using the Levy Stable distribution through a motivating example of a non-Gaussian stochastic volatilty model.

Inference with stable distribution is tricky because the density Stable.log_prob() is very expensive. In this tutorial we demonstrate three approaches to inference: (i) using the poutine.reparam effect to transform models in to a tractable form, (ii) using the likelihood-free loss EnergyDistance with SVI, and (iii)

using Stable.log_prob() which has a numerically integrated log-probability calculation.

Summary¶

Stable.log_prob() is very expensive.

Stable inference requires either reparameterization or a likelihood-free loss.

Reparameterization:

The poutine.reparam() handler can transform models using various strategies.

The StableReparam strategy can be used for Stable distributions in SVI or HMC.

The LatentStableReparam strategy is a little cheaper, but cannot be used for likelihoods.

The DiscreteCosineReparam strategy improves geometry in batched latent time series models.

Likelihood-free loss with SVI:

The EnergyDistance loss allows stable distributions in the guide and in model likelihoods.

Table of contents¶

Fitting a single distribution to log returns using

EnergyDistanceModeling stochastic volatility using:

Reparameterization with

poutine.reparamNumerically integrated log-probability with

Stable.log_prob()

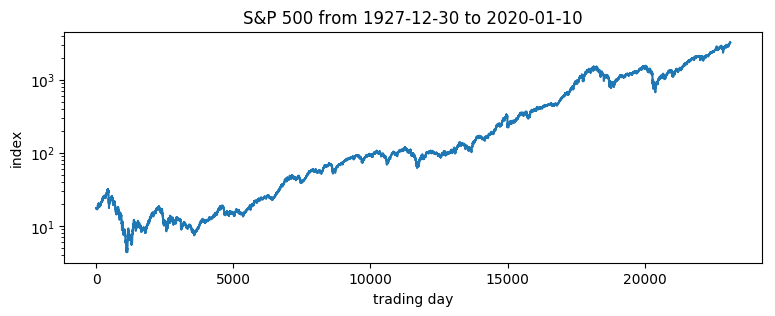

Daily S&P 500 data¶

The following daily closing prices for the S&P 500 were loaded from Yahoo finance.

[1]:

import math

import os

import torch

import pyro

import pyro.distributions as dist

from matplotlib import pyplot

from torch.distributions import constraints

from pyro import poutine

from pyro.contrib.examples.finance import load_snp500

from pyro.infer import EnergyDistance, Predictive, SVI, Trace_ELBO

from pyro.infer.autoguide import AutoDiagonalNormal

from pyro.infer.reparam import DiscreteCosineReparam, StableReparam

from pyro.optim import ClippedAdam

from pyro.ops.tensor_utils import convolve

%matplotlib inline

assert pyro.__version__.startswith('1.9.1')

smoke_test = ('CI' in os.environ)

[2]:

df = load_snp500()

dates = df.Date.to_numpy()

x = torch.tensor(df["Close"]).float()

x.shape

[2]:

torch.Size([23116])

[3]:

pyplot.figure(figsize=(9, 3))

pyplot.plot(x)

pyplot.yscale('log')

pyplot.ylabel("index")

pyplot.xlabel("trading day")

pyplot.title("S&P 500 from {} to {}".format(dates[0], dates[-1]));

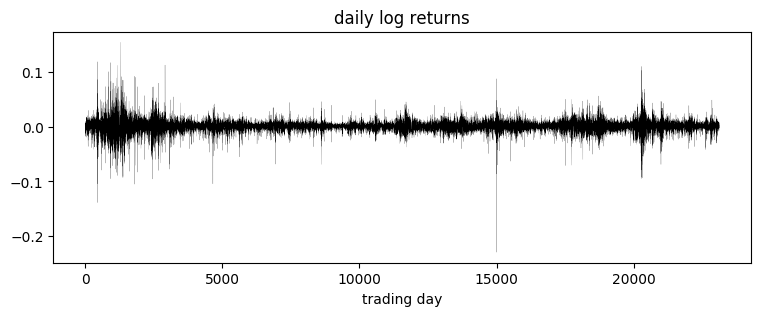

Of interest are the log returns, i.e. the log ratio of price on two subsequent days.

[4]:

pyplot.figure(figsize=(9, 3))

r = (x[1:] / x[:-1]).log()

pyplot.plot(r, "k", lw=0.1)

pyplot.title("daily log returns")

pyplot.xlabel("trading day");

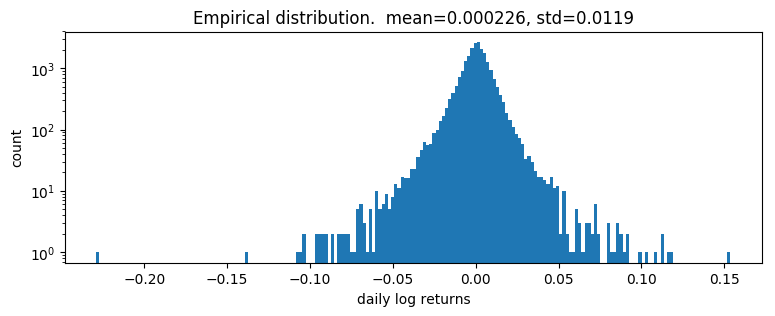

[5]:

pyplot.figure(figsize=(9, 3))

pyplot.hist(r.numpy(), bins=200)

pyplot.yscale('log')

pyplot.ylabel("count")

pyplot.xlabel("daily log returns")

pyplot.title("Empirical distribution. mean={:0.3g}, std={:0.3g}".format(r.mean(), r.std()));

Fitting a single distribution to log returns¶

Log returns appear to be heavy-tailed. First let’s fit a single distribution to the returns. To fit the distribution, we’ll use a likelihood free statistical inference algorithm EnergyDistance, which matches fractional moments of observed data and can handle data with heavy tails.

[6]:

def model():

stability = pyro.param("stability", torch.tensor(1.9),

constraint=constraints.interval(0, 2))

skew = 0.

scale = pyro.param("scale", torch.tensor(0.1), constraint=constraints.positive)

loc = pyro.param("loc", torch.tensor(0.))

with pyro.plate("data", len(r)):

return pyro.sample("r", dist.Stable(stability, skew, scale, loc), obs=r)

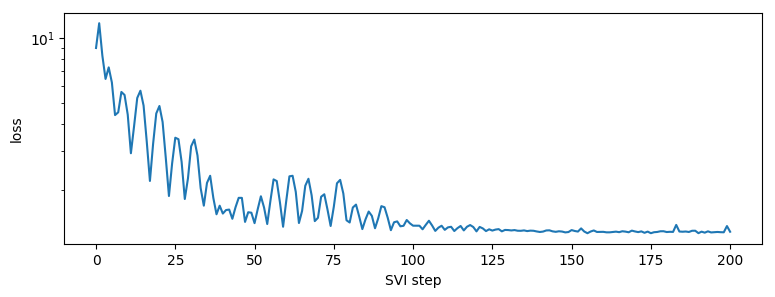

[7]:

%%time

pyro.clear_param_store()

pyro.set_rng_seed(1234567890)

num_steps = 1 if smoke_test else 201

optim = ClippedAdam({"lr": 0.1, "lrd": 0.1 ** (1 / num_steps)})

svi = SVI(model, lambda: None, optim, EnergyDistance())

losses = []

for step in range(num_steps):

loss = svi.step()

losses.append(loss)

if step % 20 == 0:

print("step {} loss = {}".format(step, loss))

print("-" * 20)

pyplot.figure(figsize=(9, 3))

pyplot.plot(losses)

pyplot.yscale("log")

pyplot.ylabel("loss")

pyplot.xlabel("SVI step")

for name, value in sorted(pyro.get_param_store().items()):

if value.numel() == 1:

print("{} = {:0.4g}".format(name, value.squeeze().item()))

step 0 loss = 7.497945785522461

step 20 loss = 2.0790653228759766

step 40 loss = 1.6773109436035156

step 60 loss = 1.4146158695220947

step 80 loss = 1.306936502456665

step 100 loss = 1.2835698127746582

step 120 loss = 1.2812254428863525

step 140 loss = 1.2803162336349487

step 160 loss = 1.2787212133407593

step 180 loss = 1.265405535697937

step 200 loss = 1.2878881692886353

--------------------

loc = 0.0002415

scale = 0.008325

stability = 1.982

CPU times: total: 828 ms

Wall time: 2.93 s

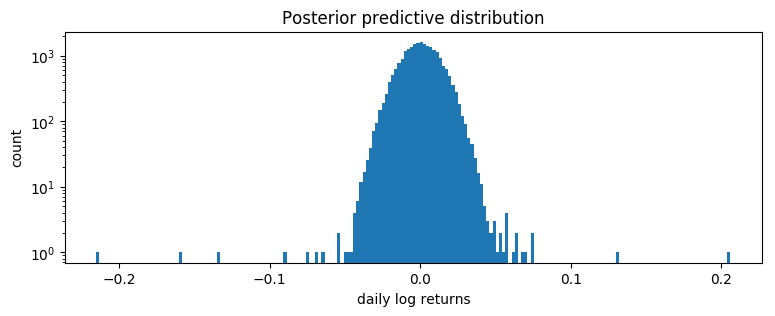

[8]:

samples = poutine.uncondition(model)().detach()

pyplot.figure(figsize=(9, 3))

pyplot.hist(samples.numpy(), bins=200)

pyplot.yscale("log")

pyplot.xlabel("daily log returns")

pyplot.ylabel("count")

pyplot.title("Posterior predictive distribution");

This is a poor fit, but that was to be expected since we are mixing all time steps together: we would expect this to be a scale-mixture of distributions (Normal, or Stable), but are modeling it as a single distribution (Stable in this case).

Modeling stochastic volatility¶

We’ll next fit a stochastic volatility model. Let’s begin with a constant volatility model where log price \(p\) follows Brownian motion

where \(w_t\) is a sequence of standard white noise. We can rewrite this model in terms of the log returns \(r_t=\log(p_t\,/\,p_{t-1})\):

Now to account for volatility clustering we can generalize to a stochastic volatility model where volatility \(h\) depends on time \(t\). Among the simplest such models is one where \(h_t\) follows geometric Brownian motion

where again \(v_t\) is a sequence of standard white noise. The entire model thus consists of a geometric Brownian motion \(h_t\) that determines the diffusion rate of another geometric Brownian motion \(p_t\):

Usually \(v_1\) and \(w_t\) are both Gaussian. We will generalize to a Stable distribution for \(w_t\), learning three parameters (stability, skew, and location), but still scaling by \(\sqrt h_t\).

Our Pyro model will sample the increments \(v_t\) and record the computation of \(\log h_t\) via pyro.deterministic. Note that there are many ways of implementing this model in Pyro, and geometry can vary depending on implementation. The following version seems to have good geometry, when combined with reparameterizers.

[9]:

def model(data):

# Note we avoid plates because we'll later reparameterize along the time axis using

# DiscreteCosineReparam, breaking independence. This requires .unsqueeze()ing scalars.

h_0 = pyro.sample("h_0", dist.Normal(0, 1)).unsqueeze(-1)

sigma = pyro.sample("sigma", dist.LogNormal(0, 1)).unsqueeze(-1)

v = pyro.sample("v", dist.Normal(0, 1).expand(data.shape).to_event(1))

log_h = pyro.deterministic("log_h", h_0 + sigma * v.cumsum(dim=-1))

sqrt_h = log_h.mul(0.5).exp().clamp(min=1e-8, max=1e8)

# Observed log returns, assumed to be a Stable distribution scaled by sqrt(h).

r_loc = pyro.sample("r_loc", dist.Normal(0, 1e-2)).unsqueeze(-1)

r_skew = pyro.sample("r_skew", dist.Uniform(-1, 1)).unsqueeze(-1)

r_stability = pyro.sample("r_stability", dist.Uniform(0, 2)).unsqueeze(-1)

pyro.sample("r", dist.Stable(r_stability, r_skew, sqrt_h, r_loc * sqrt_h).to_event(1),

obs=data)

Fitting a Model with Reparameterization¶

We use two reparameterizers: StableReparam to handle the Stable likelihood (since Stable.log_prob() is very expensive), and DiscreteCosineReparam to improve geometry of the latent Gaussian process for v. We’ll then use reparam_model for both inference and prediction.

[10]:

reparam_model = poutine.reparam(model, {"v": DiscreteCosineReparam(),

"r": StableReparam()})

[11]:

%%time

pyro.clear_param_store()

pyro.set_rng_seed(1234567890)

def fit_model(model):

num_steps = 1 if smoke_test else 3001

optim = ClippedAdam({"lr": 0.05, "betas": (0.9, 0.99), "lrd": 0.1 ** (1 / num_steps)})

guide = AutoDiagonalNormal(model)

svi = SVI(model, guide, optim, Trace_ELBO())

losses = []

stats = []

for step in range(num_steps):

loss = svi.step(r) / len(r)

losses.append(loss)

stats.append(guide.quantiles([0.325, 0.675]).items())

if step % 200 == 0:

median = guide.median()

print("step {} loss = {:0.6g}".format(step, loss))

return guide, losses, stats

guide, losses, stats = fit_model(reparam_model)

print("-" * 20)

for name, (lb, ub) in sorted(stats[-1]):

if lb.numel() == 1:

lb = lb.squeeze().item()

ub = ub.squeeze().item()

print("{} = {:0.4g} ± {:0.4g}".format(name, (lb + ub) / 2, (ub - lb) / 2))

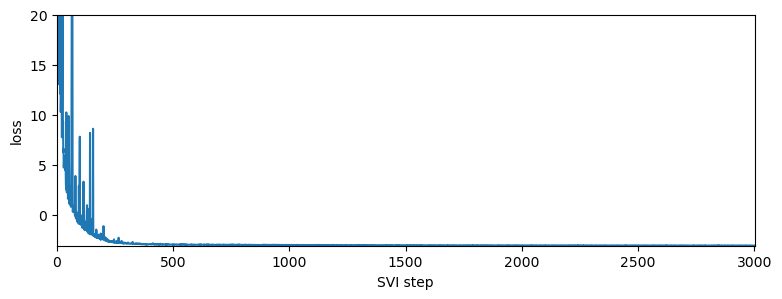

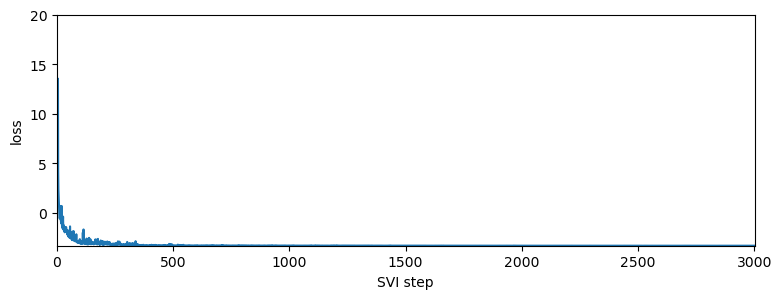

pyplot.figure(figsize=(9, 3))

pyplot.plot(losses)

pyplot.ylabel("loss")

pyplot.xlabel("SVI step")

pyplot.xlim(0, len(losses))

pyplot.ylim(min(losses), 20)

step 0 loss = 2244.54

step 200 loss = -1.16091

step 400 loss = -2.96091

step 600 loss = -3.01823

step 800 loss = -3.03623

step 1000 loss = -3.04261

step 1200 loss = -3.07324

step 1400 loss = -3.06965

step 1600 loss = -3.08399

step 1800 loss = -3.08298

step 2000 loss = -3.08325

step 2200 loss = -3.09142

step 2400 loss = -3.09739

step 2600 loss = -3.10487

step 2800 loss = -3.09952

step 3000 loss = -3.10444

--------------------

h_0 = -0.2587 ± 0.00434

r_loc = 0.04707 ± 0.002965

r_skew = 0.001134 ± 0.0001323

r_stability = 1.946 ± 0.001327

sigma = 0.1359 ± 6.603e-05

CPU times: total: 19.7 s

Wall time: 2min 54s

[11]:

(-3.119090303321589, 20.0)

It appears the log returns exhibit very little skew, but exhibit a stability parameter slightly but significantly less than 2. This contrasts the usual Normal model corresponding to a Stable distribution with skew=0 and stability=2. We can now visualize the estimated volatility:

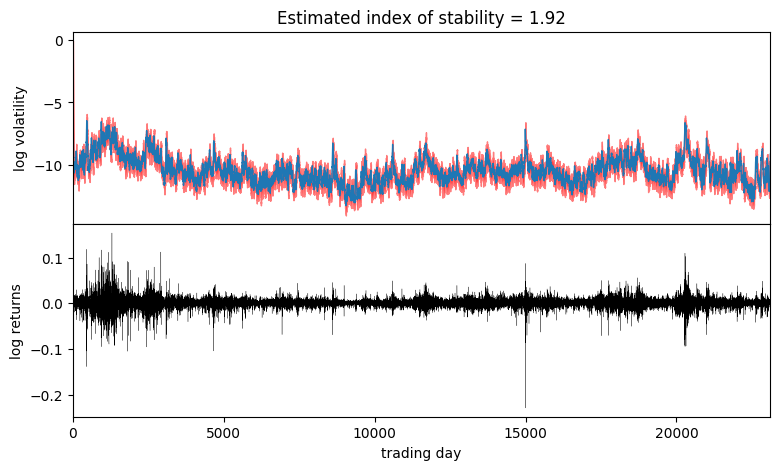

[12]:

fig, axes = pyplot.subplots(2, figsize=(9, 5), sharex=True)

pyplot.subplots_adjust(hspace=0)

axes[1].plot(r, "k", lw=0.2)

axes[1].set_ylabel("log returns")

axes[1].set_xlim(0, len(r))

# We will pull out median log returns using the autoguide's .median() and poutines.

num_samples = 200

with torch.no_grad():

pred = Predictive(reparam_model, guide=guide, num_samples=num_samples, parallel=True)(r)

log_h = pred["log_h"]

axes[0].plot(log_h.median(0).values, lw=1)

axes[0].fill_between(torch.arange(len(log_h[0])),

log_h.kthvalue(int(num_samples * 0.1), dim=0).values,

log_h.kthvalue(int(num_samples * 0.9), dim=0).values,

color='red', alpha=0.5)

axes[0].set_ylabel("log volatility")

stability = pred["r_stability"].median(0).values.item()

axes[0].set_title("Estimated index of stability = {:0.4g}".format(stability))

axes[1].set_xlabel("trading day");

Observe that volatility roughly follows areas of large absolute log returns. Note that the uncertainty is underestimated, since we have used an approximate AutoDiagonalNormal guide. For more precise uncertainty estimates, one could use HMC or NUTS inference.

Fitting a Model with Numerically Integrated Log-Probability¶

We now create a model without reparameterization of the Stable distirbution. This model will use the Stable.log_prob() method in order to calculate the log-probability density.

[13]:

from functools import partial

model_with_log_prob = poutine.reparam(model, {"v": DiscreteCosineReparam()})

[14]:

%%time

pyro.clear_param_store()

pyro.set_rng_seed(1234567890)

guide_with_log_prob, losses_with_log_prob, stats_with_log_prob = fit_model(model_with_log_prob)

print("-" * 20)

for name, (lb, ub) in sorted(stats_with_log_prob[-1]):

if lb.numel() == 1:

lb = lb.squeeze().item()

ub = ub.squeeze().item()

print("{} = {:0.4g} ± {:0.4g}".format(name, (lb + ub) / 2, (ub - lb) / 2))

pyplot.figure(figsize=(9, 3))

pyplot.plot(losses_with_log_prob)

pyplot.ylabel("loss")

pyplot.xlabel("SVI step")

pyplot.xlim(0, len(losses_with_log_prob))

pyplot.ylim(min(losses_with_log_prob), 20)

step 0 loss = 10.872

step 200 loss = -3.21741

step 400 loss = -3.28172

step 600 loss = -3.28264

step 800 loss = -3.28722

step 1000 loss = -3.29258

step 1200 loss = -3.28663

step 1400 loss = -3.30035

step 1600 loss = -3.29928

step 1800 loss = -3.30102

step 2000 loss = -3.30336

step 2200 loss = -3.30392

step 2400 loss = -3.30549

step 2600 loss = -3.30622

step 2800 loss = -3.30624

step 3000 loss = -3.30575

--------------------

h_0 = -0.2038 ± 0.005494

r_loc = 0.04509 ± 0.003355

r_skew = -0.09735 ± 0.02454

r_stability = 1.918 ± 0.002963

sigma = 0.1391 ± 6.794e-05

CPU times: total: 1h 20min 43s

Wall time: 1h 7s

[14]:

(-3.3079991399111877, 20.0)

The log returns exhibit a negative skew which was not captured by the model with reparameterization of the Stable distribution. The negative skew means that negative log returns have a heavier tail than the tail of positive log returns. Also the stability parameter is slightly lower than the one found using the model with reparameterization of the Stable distribution (lower stability means heavier tails).

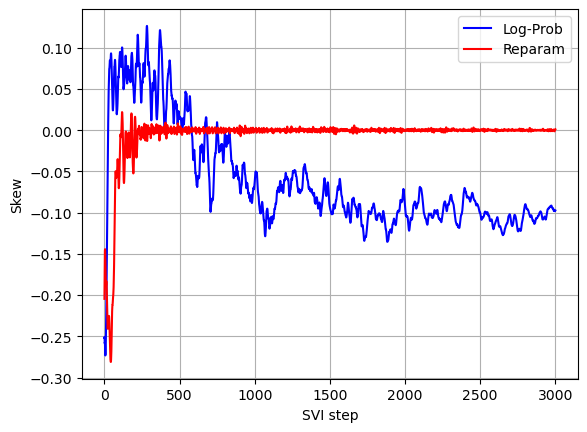

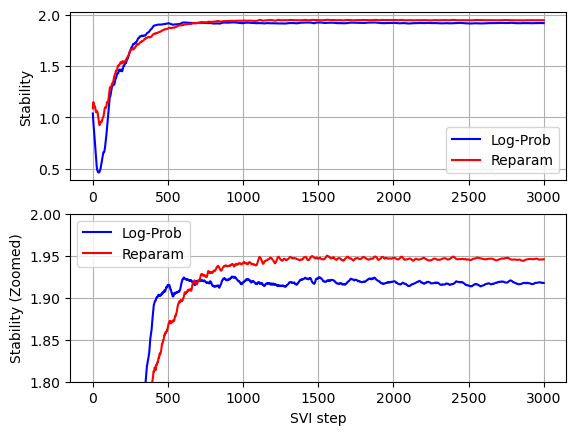

Comparing convergence of the two models (see below graphs) we can see that without Stable distribution reparameterization less iterations are required for the stability parameter to converge, but since per iteration running times without Stable distribution reparameterization is much higher, the overall running time without Stable distribution reparameterization is significantly higher.

[15]:

stability_with_log_prob = []

skew_with_log_prob = []

for stat in stats_with_log_prob:

stat = dict(stat)

stability_with_log_prob.append(stat['r_stability'].mean().item())

skew_with_log_prob.append(stat['r_skew'].mean().item())

stability = []

skew = []

for stat in stats:

stat = dict(stat)

stability.append(stat['r_stability'].mean().item())

skew.append(stat['r_skew'].mean().item())

[16]:

def plot_comparison(log_prob_values, reparam_values, xlabel, ylabel):

pyplot.plot(log_prob_values, color='b', label='Log-Prob')

pyplot.plot(reparam_values, color='r', label='Reparam')

pyplot.xlabel(xlabel)

pyplot.ylabel(ylabel)

pyplot.legend(loc='best')

pyplot.grid()

pyplot.subplot(2,1,1)

plot_comparison(stability_with_log_prob, stability, '', 'Stability')

pyplot.subplot(2,1,2)

plot_comparison(stability_with_log_prob, stability, 'SVI step', 'Stability (Zoomed)')

pyplot.ylim(1.8, 2)

[16]:

(1.8, 2.0)

[17]:

plot_comparison(skew_with_log_prob, skew, 'SVI step', 'Skew')